…[H]uman beings are surprisingly resistant to conceptual change.

– Professor Moti Nissani (http://drnissani.net/mnissani/pagepub/ccc&i.htm)

The psy-op goes on

by Timothy Paul Madden, consulting forensic economist, and historian of equity, law, and policy.

Have you ever wondered why 1%-per-day is 3,678% per annum in the U.K., but legally only 365% per annum in the U.S. and Canada? Never mind. It’s probably not important.

Double-dipping Double-whammy

By total amount, and by up to several-times-over, all of the alleged debt (and therefore money) in the world today is a function of a fraudulent feedback-loop accounting-device disguised and pretended as a method of interest calculation.

For those trying to make economic sense of it, it cannot be done. The first thing to note is that the device has been recognised (and quite correctly so) as especially and insidiously fraudulent, and illegal and banned throughout the U.K. since 1971 as civil and criminal fraud, while the same device is required by law throughout the U.S. under and since the 1968 federal Truth in Lending Act.

In theory, that is impossible. For it to then persist for fifty years is inconceivable.

Trillions upon trillions of pounds (£) in future revenues ultimately turned on it, yet after having also fully-recognised and identified the criminal substance of the device (under the Crowther Report in 1971), the new law against it was ultimately sold to the public in 1974, both inside and outside the U.K., as tending to a mere administrative change in statutory regulations regarding the disclosure of interest rates to credit consumers.

There were in fact two separate events, and two corresponding critical realities for the public to be aware of.

The first was that the broadly-defined private financial system in the U.K. had for centuries been using a mathematically-invalid (and systemically fraudulent) method / device of interest calculation that, at the long-term average represented rate of 6%, was actually nearly 6.2%, and which ultimately represented about a 10% increase in the profitability, per se, of the private financial system in any given year, and with massive wealth-concentration and wealth-consumption implications over even mere decades.

Applied to all credit assets in the U.K., the differential amount at a stated 6% per annum would have gone a long way, for example, towards covering the lavish lifestyles of the aristocracy without any corresponding decrease in their amount or rate of reinvestment to ensure ever more extensive future ownership and interest income. The ultimate financial device for having / reinvesting your cake and eating / spending it too.

The second was that henceforth all of the creditors would be compelled to use the mathematically-accurate actuarial formula that had already been in use for centuries by insurance companies, and which all of the banks and other nominal institutional-creditors already used for all substantive internal accounting purposes.

The owners and people running the insurance companies did it right, because it was to their financial advantage to do so. The owners and people running the private banks and other nominal creditors did it wrong, because it was to their financial advantage to do so, and because it was an easy-lie and easy–deception to sell to the public as long as interest rates were relatively low. It has never been any more complicated than that.

The two most critical ideas that they had to prevent from forming in the minds of the public were:

- That the device had never had any real purpose other than to misrepresent and understate the real interest rate to the borrower, and

- That all the debt then in existence in 1974 (by total amount) would not have existed without or in the absence of the device.

Based on the findings-of-fact of and under the Crowther Committee Investigation, by merely banning the fraudulent device going forward, the de facto government policy became:

We are not going to allow the private financial system to directly steal any more money from you using this fraudulent device. But you have to re-pay or pay them again for all of the money that they have already stolen from you while concurrently hiding it from you by charging-it-off and rolling-it-over into your interest-bearing principal balances (and by thus quietly extending the amortization periods), and continue to incur and to pay them more interest on it until you do.

Leveraged-embezzlement by design

It was the same result as if it had been discovered that an embezzler working at the bank had been skimming a portion of your monthly mortgage payment into his own pocket, so that it was also not being applied to your principal outstanding, with the larger result being that even though you have been paying for, say, twenty years, and the mortgage is in fact paid off without the theft from your payment-stream, the bank still shows a substantial balance outstanding and another five years of payments (plus more interest yet to accrue) still owing in order to reduce the balance to zero.

If 1974 were the year that that fraud / embezzlement were discovered, then the de facto government policy was that you still owed the fraudulently-inflated balance, and had to keep paying for another five years, even though the embezzler / bank could no longer employ the fraudulent device. Needless to say, it was a socio-financially dicey situation.

The government could not fully explain the fraud and its nature to the public, without revealing that all the debt then in existence (by total amount – and then some) was merely the compounded-balance-carry-forward of the fraudulent overcharges. That is why the fraudulent-device was downplayed and quasi-rehabilitated to the public between 1971 and 1974 (as a tired old warhorse being put out to pasture, instead of as a convicted felon going to prison (or rather that they had already been executed)).

And of course the then still-active mortgages were a relatively small part of the problem.

The most significant group of direct victims were those who had already paid off their mortgages and all other loans under the fraudulent device throughout. Upon discovery and recognition of the nature and extent of its fraudulent substance, a massive legal and equitable debt and trust was automatically established in favour of all of those victims of the device. The onus then shifts to the institutions to prove that they (owners and management) were not aware – or were not reasonably expected to be aware – of its fraudulent substance and of the exponential nature of that fraud. As will become increasingly obvious – they were dead-in-the-water.

The current nominal Great Reset is a rerun of the same business-model. They need to collapse and reset the system (capitalize-their-apparent-gains) before a sufficient number of people realise that it is all based on fraud and naked presumption, and with no lawful, legal, or equitable basis to it (the fraudulent device is just one of several – but a solid place to start).

No front-page News

The event regardless should have been front-page-news all over the world as a near-impossible victory by the little people over systemic corporate and commercial domination. As a centuries-long entrenched business-custom or industry-practice the fraudulent device would normally have been unassailable. It was only the near-inconceivable fraud and criminality of it (as interest rates then rose generally (or were pushed) above historical norms) that gave the U.K. government (beginning with Labour in 1968) sufficient power-in-fact to compel the entire established financial system throughout the U.K. to stop using the fraudulent device (and to start doing it right – and at least a decade before the ubiquitous personal-computer at that).

But as soon as the banks / bankers and their owners knew that that battle had been lost, they shifted their efforts to suppress generally the fact of the wrongful nature of the long-entrenched device, and why it was being banned, while concurrently referring to the centuries-old and mathematically-correct actuarial method to be required under the new law as, for example, and merely “the more up to date formula”.

Also, everything that follows is based on the assumption that nominal creditors are in the money-lending business, and performing a purely intermediary / administrative function (i.e., as a middleman between savers and borrowers, and who uses the fraudulent device to determine the interest charges to the borrower, and then also pays interest to the depositors at the same stated rate, but using the actuarial formula, so as to isolate and demonstrate the effect of the subject device and only the subject device. If there is no difference, then they would be the same amounts)). We are examining the theoretical base-case as a basic-honesty-check before we even begin considering the effects of the device under additional forms of financial leverage.

The most salient (in fact mind-blowing) financial aspect of the fraudulent-device is the proportion of the aggregate interest payments made by borrowers that gets diverted directly into the pockets of the lender / administrative-middleman (as an increase in (pretended) earned-income), and does not get passed on to nominal savers / bond-holders or depositors.

On a mortgage amortized over a 30-year term, the extra-money-cost from the use of the fraudulent-device, as a percentage of all the interest money paid by the borrower, increases exponentially from 1/2 of 1% at a stated 1% per annum, to 48% (!!!) at a stated 15% per annum (or “prime plus 3%” as a variable rate – as the average “retail” rate).

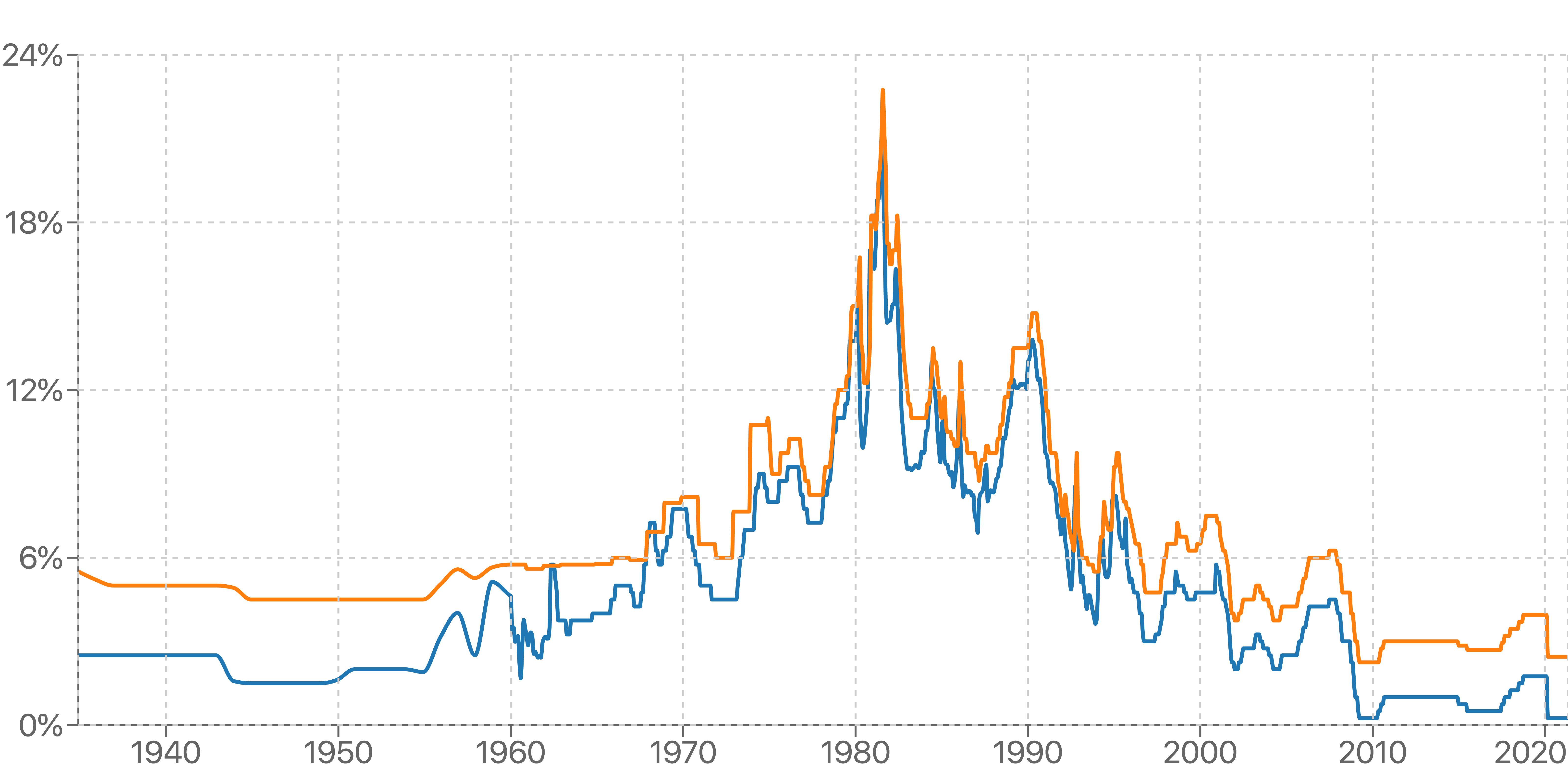

The graph (orange-line) gives the official Bank Prime Rate or Bank Rate in Canada from 1935 to 2020 (the blue line is the nominal Overnight Rate – and the U.S. Fed Rate is normally about one percentage point less (than the orange line) at any given point).

If you draw (or follow) the horizontal line at 6% per annum, then the area above the line from 1968 to 1998 represents tens of trillions of dollars of wealth (in the combined U.S. and Canadian economies) that was fraudulently transferred to and obtained by the private financial system as a direct result of the fraudulent accounting device (i.e., over and above the already substantial normal or entrenched systemic fraud at the long-term-average or norm of 6%).

The most perilous problem for the private-system, from a global perspective, presented itself following the 1971 release and publication of the official Crowther Committee Investigation and Report on the consumer credit industry in the U.K.

The Committee and its official Report identified the feedback-loop device as satisfying the tests of both civil and criminal fraud under English law, meaning that it is inherently fraudulent-in-its-design with or without proof of conscious intent-to-defraud by the party using it. It was vigorously denounced as “false and seriously misleading” – itself the understatement-of-the-century, and would ultimately be banned throughout the U.K. under or by reason of the Consumer Credit Act of 1974 (and the criminal law of course).

Legally, the findings of the Crowther Committee exposed and identified the device as malum in se, or evil / wrongful of itself. It is pure deceit with no redeeming or positive characteristics.

In plain English, the feedback-loop device is a purported measuring-and-conversion device employed by professional creditors that measures and converts the time-value-of-money (converts time into interest-$-amounts), and which is used almost exclusively for periods of less than a year, whose foundational premise is that money has no incremental-time-value for any period less than a year. Whether by words or by numbers – it is and remains wholly non sequitur (clinically-insane) and founded in fraud (like a set of special rigged-scales for weighing gold).

Put another way, the more financially sophisticated you are, the greater your appreciation of its fraudulent substance and nature / extent, and of your own unearned and unjust gains from it.

For at least the previous century, whenever the issue had come up, the bankers had dealt with it by naked denial or – when trapped, or otherwise deeming it necessary or expedient – by swearing to government regulators and to the public generally that it is an unknown anomaly, and of no material consequence.

When directly challenged, and testifying in Canada under oath before the Select Standing Committee on Banking and Commerce in 1928, for example, the spokesman for the private chartered banks (Mr. M. W. Wilson) said of the fraudulent device / discrepancy / overcharge:

Mr. Wilson: It [use of the fraudulent-device] makes an infinitesimal difference. That is not the reason it is done, I give you my word for it. (Parliament of Canada – Select Standing Committee on Banking and Commerce hearing transcripts, [1928] p. 464.)

Likewise the (mostly banker-written) Encyclopedia of Banking and Finance (1931 and 1937) (Munn, Glenn G. (General Editor)) acknowledged the fact of the math-error, and of the at-least-constructive fraud, under the general heading of Interest:

…if the interest period is less than one year, the [amount of interest determined under the fraudulent device] is greater than the true interest rate… Practically, however, the difference is disregarded.

Bear in mind also, for future reference and throughout, that the banking industry measures financial performance by the basis point or 1/100th of 1%. At the time of Mr. Wilson’s testimony and evidence the Bank Act limit was 7% per annum where the fraudulent device accounts for about 10% of all the interest paid / collected (over 30 years or on a 30-year loan-contract).

Meanwhile, back in 1968, as the Crowther Committee began its comprehensive three-year Investigation in the U.K., the fraudulent feedback-loop device was made mandatory / required-by-law for all creditors throughout the U.S. by Congress under the federal Truth in Lending Act (Regulation Z). The U.S. Congress has nothing if not a sense of humour.

Meanwhile in Canada, the feedback-loop device had been expressly recognised as fraudulent, and constructively illegal on mortgage-secured-debt since 1880, and on most all other debt since 1897, under federal securities law, but creditors in Canada had then been simply ignoring or evading those laws for 80-some years (with the rather shameless assistance of the lawyers and the (former-bank-lawyer-dominated) Courts), and use of the device has remained throughout Canada to this day.

As just a relatively minor (tip-of-the-iceberg-like) example, in 1897, the (typeset) bill passed by the House of Commons in Canada required the creditors to declare and disclose “what is truly the per annum rate” – but after the third-reading in the House, someone in the appointed and unelected Senate (or ex-Bankers’ Club) appears to have whispered something in the clerk’s ear, and those words were crossed out and replaced with the hand-written insertion the “annual rate [which is] equivalent”. The appointed former bank-lawyer / judges then ruled that “equivalent” can also mean “nominal” or literally “not-equivalent”. There is regardless no record of any debate or other due process to account for the change in the words.

And then the otherwise completed bill was mysteriously overlooked on Proclamation Day for 1897/98, and they had to go through the whole process again, and it wasn’t until 1906 that the still-altered version was formally enacted into law.

In other words, if you consider the history of the fraudulent device in any given country, you will observe a virtual cascade of non sequiturs. But if you examine even just these three together (the U.K., Canada, and the U.S.) the seditious and criminal conspiracy is so obvious and clear that the perpetrators would, at least in wartime, be summarily-executed. There would not even be a trial (I do not in any way recommend doing so, but it is what it is. Sedition is sedition. Treason is treason).

If we use what I believe to be a reasonably accurate / appropriate $10 trillion as a representative-single-mortgage / model for the broadly-defined consumer credit market in the U.S. and Canada for the 30-year period 1968 to 1998, then with no interest the monthly (principal only) payments from the borrowers to the nominal lenders are $2.777 billion, and the feedback-loop device has no effect (the whole $2.777 billion is passed on to savers each month).

If interest is introduced at a stated 1% per annum, then the required monthly payments increase to $3.216 billion, and of that, over the 30-year period the feedback-loop device fraudulently diverts $880 million to the account of the middleman (or nominal lender). The $880 million represents about 1/2 of 1% of the total interest paid by the borrower.

If the interest rate is increased to a stated 6%, then the monthly payments increase to $5.99 billion, and of that, over the 30-year period the feedback-loop device fraudulently diverts $959 billion, or 8.25% of it, to the account of the middleman (or nominal lender).

If the interest rate is increased to a stated 15%, then the monthly payments increase to $12.24 billion, and of that, over the 30-year period the feedback-loop device fraudulently diverts $17.8 trillion or 48% of it to the account of the middleman (or nominal lender).

It is the same total input and quasi-throughput either way. You start with a principal debt of $10 trillion with interest at a stated 15% per annum, and you make 360 monthly payments of $12.24 billion over 30-years (total $45.5 trillion).

But there is a switch on the wall that states:

Use fraudulent feedback-loop device.

If you turn the switch “Off”, then there is no feedback-loop effect or bonus to the nominal lender(s).

The borrowers pay $35.5 trillion of interest over 30-years (plus $10 trillion of principal), the bond-holders and savers receive about $35 trillion of it (plus repayment of their $10 trillion of principal),[1] and the middleman consumes about 3% of the original principal, or $300 billion, to cover their actual administrative expenses in coordinating the monthly payment and pass-through.

If you turn the switch “On”, then there is a $17.8 trillion ($17,800,000,000,000) feedback-loop bonus to the nominal lenders / account-administrators.

The borrowers pay $35.5 trillion of interest (plus / combined-with $10 trillion of principal) over 30-years, the bond-holders and savers receive about $17 trillion of it (at a real 15% over 18.7 years, at which point their $10 trillion of principal has been repaid as well, and they receive no more payments), and the middlemen consume / pocket the near $18 trillion difference (the entire final 11.3 years of payments from the borrower) for coordinating the monthly payment and (no) pass-through.

Regardless of the actual (or most appropriate for the model) total amount of principal, the switch in fact remained “On” for that 30 years from 1968 to 1998 in Canada and the U.S., and did in fact so divert or consume almost half of all the interest money paid by borrowers over that period (but uniformly or gradually in fact over the whole 30 years).

And, here again, this is just one aspect or element in just a much larger mere administrative-fraud. It does not yet deal with the massive fraud against equity that underlies the process by which the credit-so-administered or accounted-for, is created.

It is the same result as society hiring the private financial system to act as a pure coordinator of payments between borrowers and savers at the same interest rate so as to balance the economy regardless of the general level of interest rates. Assume also that the private financial system is reimbursed and compensated under a separate parallel contract for its actual administrative expenses (and normal profit for the resources employed) which total about 3% of the initial principal amount over the 30-year term and amortisation (so it receives $300 billion ($300,000,000,000) over 30-years to process the account payments – it’s a sweet deal).

But there is also an administrators-bonus because the administrator uses the fraudulent device to determine the interest charges to the borrower, and then switches to the correct way to pay the depositors (under the model – in practice they use a different way to achieve nearly the same result). At a stated and agreed 1% per annum that administrators-bonus is $880 million against a $300 billion 30-year administrative contract on $10 trillion of initial principal.

So under the program, the depositors and savers put up the $10 trillion, and the borrowers then make the stipulated monthly payments, the administrators process them and pay forward to the depositors and savers the same amount of payment (combined payment of principal and interest) but with the interest component determined using the correct actuarial formula (which also applies the larger-difference to principal reduction), and leaving a residual $880 million at the end as the administrators-bonus which also comes at the expense of the depositors and savers.

At a stated 1% per annum, the middleman obtains an $880 million bonus, and which represents about 1/2 of 1% of the total interest paid, meaning that the middleman is compensated 99.5% for its legitimate administrative function, and 0.5% from the fraudulent device.

At a stated 6% – the long term (pre-1968) average stated rate – the bonus increases to $959 billion or more than three-times the value of the administration contract. Now the compensation is 25% legitimate and 75% fraud.

At a stated 15% the compensation ($18.1 trillion) is almost 99.5% fraud, and only $300 billion or about 1/2 of 1% legitimate.

The administrators-bonus increases exponentially to $17.8 trillion at a stated and agreed (believed-to-be) 15% and represents 48% of all the interest money paid in by the borrowers, and at the expense of the depositors and savers.

This actually happened.

It massively affected the lives of about half the people living today.

But no one officially even mentioned it. Isn’t that odd?

At a stated 1% per annum, the money difference is a little over $687,000 per day, that is also constructively charged-off to the non-reduction in the account balance, and creates a daily differential of about $1.3 million. In order to obtain their $880 million rake-off over 30-years, they have to maintain a daily financial gain from the device, per se, of $1.3 million – half ($687,000) as extra income, and the other half as an ex-temporal / de facto extension of the amortization period (because the $687,000 that is paid goes into the middleman’s pocket and so does not reduce the principal).

To maintain the same / corresponding rate of bonus accumulation (48% over 30-years) at a stated 15% per annum requires a daily rake-off of just under $250 million, constructively or actually charged against a relative increase or non-reduction of the interest-bearing balance, for a net daily gain or differential of almost $500 million.

And the larger real economy was and is de facto concurrently and commensurately and massively both crippled and vandalized, because, even before considering nominal lending-rate / deposit-rate differences, almost 50% of the enormous amount of interest exacted from the masses at 15% (or prime plus 3% as a variable rate over the period) gets skimmed-off-the-top and does not get passed on to nominal depositors or bond-holders to be re-spent into the economy. Instead the bulk of it is / was retained by the middlemen and used to liquidate all the unfunded / kited-liabilities that had piled-up over the then previous generations.

The term kiting means “to keep (financial) paper in the air”.

I obtained an early insight into the process from a PhD thesis that I had encountered at a university grad-school library in 1986. As near as I can now recall it was titled or to the effect: Capital Cost Recovery in the Commercial Airliner Industry [circa 1923 to 1983].

An essential part of the author’s thesis (as I understood it) was that in the longer term, most successful manufacturers of airliners (e.g., Boeing, Douglas, Lockheed) had never directly recovered the investment cost of any given generation of aircraft, but rather were in a constant and dynamic process of rolling-over and deferring those costs into the next generation to be ultimately inflated out of existence. Just one year’s production of the new 747 in or for 1970, for example, might generate more total revenue to the company (Boeing) than the entire output of some earlier programs / generations of aircraft that led to it. You can only do this in a system undergoing commensurate and sustained financial-inflation from other sources – and it is existentially-risky so you have to be able to count on it.

Like surfing a steady wave of financial inflation into the future.

The private global financial system is itself doing the same thing. It robbed us all blind for a century (using a balanced array of such fraudulent devices) while concurrently kiting and rolling-over massive unsecured liabilities until it all hit-the-wall in the late 1970’s. But with a fifteen-year-burst of very high interest rates – the exponential feedback-loop device really kicks-in (especially the first five years from 1978 to 1983), and they pay off a century’s worth of kited-cheques and start the process again.

But it also left a very substantial residual that fuelled the financial-party-atmosphere of broadly-defined Wall Street as it really kicked-into-high-gear as the liquidity crisis subsided and the Fed Rate declined from its record 20.5% in August of 1981. At a stated 20.5% the same monthly payment that pays off a given debt in 13 years takes 30-years using the device. The Wall Street boys are in the business of – and exceptionally good at – finding ways to capitalize that difference on behalf of their money-power-employers, while concurrently obtaining a commensurate bonus or rake-off-from-the-rake-off for themselves.

If the total or aggregate costs of the fraudulent device were amortized and demonstrated over an average human lifetime, instead of just 30-years, then just at the long-term average stated and agreed-and-believed rate of 6% per annum (and moderate standard deviation), the private system’s ability to use the device will approximately double the interest money amount paid by a typical human consumer during their lifetime.

Also note the extent to which we were all effectively and cognitively reprogrammed or recalibrated during the assessment period itself. In 1968, the vast majority of people had never even heard the word trillion other than perhaps as an occasional generic reference to an otherwise inconceivable amount of money (or anything else). As such, our $10 trillion model may seem a wild overestimation. But by the end of the measurement period in 1998 – just the whole term of a standard residential mortgage – at or near the height of the dot-com boom, $10 trillion seems more of a really big drop in a much larger bucket, and with the public being concurrently introduced to the word quadrillion to intellectually manage the ongoing transition.

Until about fifty-years-ago, all humans who had ever lived had been able to keep track of everyone’s personal wealth using no more than 8 zeros. Just fifty years later we are rapidly approaching the world of the first trillionaire, and requiring 12 zeros. For a world with officially-near-zero price inflation, that’s a lot of zeros.

Well at least it can’t possibly get any worse.

Actually it does.

The feedback-loop device is also a short-term tactical-weapon as well as a long-term-tactical / quasi-strategic weapon.

The feedback-loop device is a device that systematically-understates the real interest rate, but also (as just seen), the greater the interest rate, the exponentially-greater the relative-understatement. That is why the money-cost-of-using-it increases from 1/2 of 1% (of all the interest paid) at a stated 1% per annum, to 48% at a stated 15% per annum, when demonstrated or applied and measured or exposed over the long (30-year) amortization or whole-contract-period.

It is in fact and by its effect a massively-financially-fraudulent device that slowly-and-relentlessly-and-systematically loots and drains entire national economies, but also has a separate (but also always-on) ultra-high-frequency or uhf-setting to manage especially the inner-cities situation and conditions, and that self-adjusts through de-facto-socio-financial-profiling.

The High, the Middle, and the Low

Assume that there is a bank that serves all classes of financial customers. Assume also that each of the following three example customers is representative (or themselves in about the centre) of a more general and identifiable-financial-class within society.

Also otherwise ignore the specific circumstances of each of the examples so as to then focus on the financial substance of the transactions. The first, for whatever reason wants the cash in the form of a loan, but does not really need the credit. The second more typically needs the credit as well as the cash for some unanticipated expense or emergency, and the third needs both to pay an electricity bill immediately or else incur a substantially greater penalty and reconnection fee.

The first customer, an upper-middle-class management-type, goes in to borrow $300 on his credit card through an ATM in the lobby, with a daily interest rate that he is told is 6% per annum. He needs the cash-advance for ten days, and under the feedback-loop device this is converted to an interest charge amount that corresponds to a real rate of 6.2% per annum.

He is followed by a tradesman who also needs to get a $300 cash-advance but is limited to going through his department-store account which charges a stated 30% per annum. He too needs the cash-advance for ten days, and the feedback-loop device converts it to an interest charge amount that corresponds to a real 35% per annum.

Finally, a man or woman from among the working-poor is referred to the payday-loan-window, where they obtain $300 cash for their $360 pay-check, due in ten days. The stated and disclosed / declared rate of interest is 730% per annum, but which is a real rate of 77,545% per annum.

The specific curve or slope of the feedback-loop device provides the socio-financial skeleton or superstructure that divides us into the High, the Middle, and the Low, according to a pyramidal-arrangement.

The upper management type in and dominating the top section of the pyramid is only cheated by about 3% per se, and this general class-level also corresponds to a difference of 29.75 years versus 30-years of payments on a mortgage (i.e., without versus with the device, at a stated 3% per annum). The feedback-loop device (currently) has almost no effect on this class of financial player (the High) at their broadly-defined personal credit-consumption level.

The marginal-middle-class tradesman is cheated by 15%, per se, in this particular case (a stated 30% being a real 35%), and which represents the (occasional-use) high-end of the range for this class (the Middle). The weighted-average stated rate for this class is (currently) about 10% per annum, where the feedback-loop device (and high standard deviation or average variance) is sufficient to double the total amount of interest money that they will pay over any given 30-year period. But they don’t tend to notice, because it is so gradual (a tiny fraction-of-a-percent-per-day) and the bulk of it ever-increasingly shows up as outstanding principal still owing which is not owing in fact.

Regardless, our representative from the working-poor (the Low) is cheated by 10,000%, per se. They are told that the rate of interest is 100-times lower than it is (or rather vice versa – the real rate is 100-times greater than they are told it is).

Bankers love it, because it has a place for everyone, and it keeps everyone in their place.

Somehow the masses (and most notably government regulators) have at best been brainwashed here to default to (consciously or unconsciously, and as an ultimate failsafe): “Well if the working-poor and others among the financially-marginalized are in such a financial position that they have to agree to pay interest amounts at (on average) what they are told and believe to be 300% per annum, then what difference does it really make that it is in fact (on average) 30,000% per annum?

First, what do the numbers mean anyway?”

They mean here that if you had what the bankers call a real-interest-rate daily-accrual deposit-account, then it would have to pay interest at an annual rate of 77,545% for $60 of interest to accrue on a deposit of $300 over ten days. The numbers mean what they say, and they say what they mean. That is why they all do it right internally.

At the short-term tactical-level, and especially in the U.S., the feedback-loop device persists especially as a means of draining working-capital from the masses according to the square-plus of how badly they need it. The more desperately they need it – the exponentially-greater the cost.

If you don’t need the credit, then it costs about 3% per annum. If you need it desperately to avoid a $100 reconnection fee or other “Whatever-it-takes-to-avoid-calling-it-interest” Fee, then it costs an average of 30,000%, or in this case, 77,545% per annum.

Here below is commentary from a lawyer and lawyers-website (lawshelf.com) in the U.S. where the feedback-loop device is required by law. The state of our reality is reflected in his brief introduction and summary description, as half-outraged yet half-apologist-in-fact, of and for a consumer loan contract (a multi-rollover-extended-payday-loan) in the U.S. (in material part, emphasis added):

The Enforceability of Adhesion Contracts

The 2016 Delaware case, James v. National Financial, LLC, is a case study in unconscionability of an adhesion contract. Here, the plaintiff, Gloria James, was a part-time housekeeper at a local hotel. She had dropped out of high school and had neither a savings account nor a checking account. To make ends meet she signed an agreement for a $200 consumer loan that was a standardized, boilerplate agreement that was provided to her on a take-it-or-leave-it basis. It was clearly an adhesion contract.

The contract’s terms called for James to make twenty-six, bi-weekly, interest-only payments of $60, followed by a twenty-seventh payment comprised of $60 in interest plus the original principal of $200. The contract required her to pay $30 per week in interest, the total payments adding up to $1,820. The annual interest rate came out to a whopping 838.45%. ….[lawshelf.com].

So what is wrong with the article?

First, all of the focus and reference to an adhesion-contract is at-best wholly irrelevant because what is admitted and described is a standard loan contract where the lender intended exactly the result they got, and solicited the woman to sign it and to enter into the deal as so presented.

The original meaning of what he refers to as an adhesion contract (as far as I know or have been exposed to) is a Bait–contract or Gotcha-contract where banks / bankers would mass-mail high-rate credit-cards to people with bank accounts, and if they used the card, then they were bound by its terms. If you took the bait by signing the contract (or a voucher using the card) or otherwise adhering or making joinder, then you are bound by the terms.

Nothing turns or changes as a result of such adhesion designation, and it appears as if the lawyer is suggesting that the lender did not intend the result but merely chose the wrong form of documentation.

More precisely, the lawyer is implying and suggesting (and also directly stating) that the wrongful act – the unconscionability – is the failure to give the woman an opportunity to negotiate the terms, and not the terms themselves, and as demanded and obtained in fact.

Second, and the overwhelming main event regardless, the rate of interest defined by the terms of the loan is 93,368% per annum and not 838%.

If you had an effective / real-interest-rate daily-accrual savings account, then it would have to pay interest at an annual rate of 93,000% for $60 to accrue on a deposit of $200 over fourteen days.

What then is accomplished by the pretence that it is only 838% per annum?

It provides a cognitive firewall allowing the business-owner and their solicitors and lawyers to self-deny their otherwise obvious crimes against humanity (trafficking in coerced human labour).

Their basic business-model is the same as that employed by the German industrialist Krupp during the Second World War. At Nuremberg, he was convicted of working some 100,000 Slavic people to death in his factories as slave-labourers on a diet of about 650 calories a day. He had had his scientists calculate the most efficient way to convert their body-mass to work-energy while leaving a minimal corpse to dispose of at the end.

The woman in the subject transaction receives $200 in exchange for an obligation to pay $1,820 by $60 every two weeks for a year, and which defines the interest rate as 93,368% per annum, and which exposes it as viciously and wantonly exploitive and in fact predatory.

By having a Truth in Lending Act that requires the lender to understate the interest rate by a factor of 100-plus times, both the lawyer and the lender and the judge and the debt-buyer can all sleep better living-in-fact off the avails of coerced-labour, and via interest at 93,000% per annum.

Both the lender and the lawyer know that the probability of her completing the contract for 26-consecutive $200-loan-renewals at $60 and 93,000% per roll-over is very low. In practice they may only receive, say, five such payments so as to only make $300 on their $200 over ten weeks. They may then, after the inevitable and planned-for default, sell the account to a debt-buyer who pays them, say, $300, for the right to collect the remaining $1,500 in payments from her, plus more interest and penalties and re-compounded expenses. The originating-lender’s function is to get her on “The Wheel” and then pass-her-on to the next processing / harvesting “Station”.

The lender may then sever their direct connection and walk away with a $600 gain on or from a $200 investment over ten weeks (and move on to the next one, etc.). But by selling the debt to a debt-buyer the debt is kept alive allowing the remaining $1,500 of payment-liabilities to continue to be carried or kited (kept in the air) as an asset on their own or someone else’s books.

The fraudulent device is what allows the lenders, the lawyers, the judges, and the debt-buyers to claim like those who aided and abetted Krupp that: “We didn’t know where the trains were taking these people. We had no idea what was going to happen to them at the other end.”

It is a de facto financial-genocide on the working-poor and of the Low more generally that accommodates the extreme moral cowardice of its most essential and material collaborators. “We didn’t know. We are financial professionals who measure performance by the basis-point or 1/100th of 1%. We had no idea that we were contracting to extract and receive interest at 93,000% per annum. We thought it was only 838% because that is what the consumer protection law requires us to declare and disclose to the borrower.”

Regardless, one way or another the overwhelmingly-corporate-micro-lenders and payday-lenders are going to obtain $60 from the working-poor for their $300 for ten days.

It is solely a question of what they are going to tell them, and as modified by the probability of getting caught in any given deception.

The current practice is (on average) to tell the members of the working-poor and others among the financially-marginalized, that the rate of interest is 300% per annum, when the payday-lender is in the business of knowing, and gaining from the fact, that it is 30,000% per annum.

Converting interest rates between different base-periods (e.g., daily, weekly or monthly rate to annual rate, or vice versa) is or requires a differential equation.

Without prejudice to the issue of what they may think about the other two classes, the constructive position of the people who substantively own the private global financial system is that while the (average) interest rate is, as a matter of objective fact, 30,000% per annum, the working-poor are intellectually incapable of appreciating why that is, and that it is also necessary to supply them instead with a pacification-rate or cognitive-valium-rate of 300% per annum.

Otherwise they might tend to get agitated, and possibly violent, if they were to be informed that the cost is what it is, the interest rate is 30,000% per annum, and that they can take-it-or-leave-it.

Interest-money and interest-rate dynamics are similar here to a tsunami as it approaches land. As the wave gets ever closer to the shore (the loan-period gets shorter), it grows exponentially-larger in height.

If I loan you a penny, and charge you a penny interest for one day, then the rate of interest (expressed annually) is absolutely astronomical (too big a number to write on the page).

But it is still only a penny.

But if I can loan a penny to each of seven billion people on Earth, and collect back a penny per day each as interest, then the rate is astronomical, and so is the amount ($70 million per day return on a $70 million investment).

The only way to truly appreciate this higher-end / uhf-setting of the feedback-loop device is by looking at the real world. I have not been following the grand totals for a few years now, but according to the 2016 report from the Financial Health Network in the U.S. alone, and as a general frame of reference:

“This year, we report that financially underserved consumers in the U.S. spent approximately $173 billion in fees and interest during 2016 to borrow, spend, save, and plan across 29 financial products in this diverse and continually growing marketplace.”

The micro-loan / payday-loan sector likely represents about $50 billion per year (of the $173 billion total) from or based on a core group of about 25 million of the working-poor (about $2,000 each in interest per year (paid and / or accrued)), at an average interest rate of about 30,000% per annum (on a per transaction basis).

So both the amounts and the rates are equally breathtaking.

There can be no mistake about it. On the facts, the money-power has deemed that the masses of the working-poor are legally competent to contract to pay interest-money-amounts at 30,000% per annum, but that they are concurrently not intellectually capable of understanding what that means.

Which raises another interesting feedback-loop question:

In junior-high-schools in the inner-city areas of the U.S., especially, do they teach the children of the working-poor to understand that their parents are paying an average 30,000% per annum for certain forms of short-term working capital?

Or are they excused from those lessons and told to go play in the school playground while across town the children of the wealthy are given advanced-level courses on how to harvest the labour-income of the masses while keeping them in a state of ignorance, perpetual-poverty, and political-powerlessness?

And if the only answer you have to it is that it is not fair because in fact they tell the same lie to the (ever-dwindling) middle class and even to their own among the wealthy too, then you did not understand the question.

The question is: Is there a core group among the working-poor in the U.S. who are incurring about $50 billion per year in interest charges at average interest rates of about 30,000% per annum?

And is it being orchestrated under a mathematically-invalid and fraudulent accounting device that has been recognized and banned as criminal fraud in the U.K. since 1971?

And is it being done as a matter of federal policy under the 1968 Truth in Lending Act?

These are simple questions with simple answers.

The same $300 for ten days costs the upper-management type about 50 cents, the marginal-middle-class tradesmen about $2.50, and the working-poor and others among the financially-marginalized $60.

Res ipsa loquitur – The thing speaks for itself.

So whether the private global money-power is employing the fraudulent feedback-loop device in always-on caterpillar / conveyor-belt (low-frequency) background-mode to slowly bleed the global economy of trillions of dollars one-generation-at-a-time over the amortization period of a mortgage, or using its more tactical short-term (ultra-high-frequency (uhf)) mode to target the working-capital of select groups to keep them just on the edge of financial starvation, it persists in fact (in about 80% of the world) as the ultimate double-dipping double-whammy device, with the added comfort of social-control.

Even for those who don’t fully understand the math, how can something this obviously important, and sufficient to have forced all of the immensely powerful banks / bankers in the U.K. (and the people who own them) to cease-and-desist an entrenched business-custom and industry-practice that had persisted for centuries, and which could easily be seen to cost the private system there tens of trillions of pounds of otherwise future revenue, and which recognised and exposed the fraudulent device as inherently and egregiously wrongful and criminal – How can all of that be simply ignored in the U.S., and Canada and whose money-power has continued on using the fraudulent device for another fifty years to this day?

Conspiracy theory my ass.

Well at least it couldn’t possibly get any worse.

Actually it does.

The Republic of South Africa, for example, is financially dominated by large English banks and their wholly-owned South African subsidiaries.

These private banks (and their owners) have maintained nominal (pretended) interest rates in South Africa at late-1970’s and early-1980’s North American levels for over fifty years, and have harvested vast amounts of wealth through their continued use of the fraudulent device (and several others) after having ceased to use it in their home market after its recognition as criminal. That is a crime against humanity – in fact and in law.

Communication of it would go something like this:

English bankers: We have to inform you that for the past fifty years we have been employing a fraudulent interest calculation device that we are banned from using in the U.K. since its recognition and exposure as criminal fraud in 1971.

Over the whole period, and under colour of law or otherwise, our use of the device has allowed us to drain a minimum of 500 billion pounds (£500,000,000,000) from the South African peoples and their economy as bonus profits sent back to the U.K.

But it’s o.k., because at the end of the fifty year period, you also still owe us another one trillion pounds (£1,000,000,000,000) because of it.

There has been some discussion in the alternative media to the effect that once its criminal substance had been exposed in 1971, that we ought to have stopped using it everywhere and not just in the U.K.[2] But those commentators clearly do not understand business, and most certainly not the business of money and of controlling access to credit.

Actually the English bankers drain South African rand from the South African labour economy, and then use the rand to purchase gold, diamonds and other natural resource wealth, and quite a lot more, from South Africa. The bankers and their owners get the real assets and the labour-energy – and the people of South Africa get the debt. It’s a brilliant scam – and of course another application of the same feedback-loop business model.

In the final analysis, the entrenched-money-power really are just a one-trick pony.

It is a form of socio-financial feedback-loop (and power-ratcheting-device) called all-or-nothing.

You can’t ever call-them on anything illegal, no matter how flagrantly wrongful and / or criminal – otherwise – Gasp! – the system will collapse!

The chain-of-reasoning then truncates before getting to: What system? Whose system? And whom does it serve?

Think of the device as a test of the money-power’s basic restraint, good-faith, and trustworthiness.

When confronted at a stated 7% which was a real 7.2% to the banker (and the farmer /borrower), Mr. Wilson (in 1928) replied sharply and indignantly that the difference between the two (0.2%) is “infinitesimal” and “I give you my word on it”. It is now 300% versus 30,000%, and they still haven’t said anything.

At what point then will the free-riding-parasite-money-power come clean and admit and inform the public that they’ve been using a massively bogus formula to calculate interest, and that they now nominally own the planet as a result?

Hint: It rhymes with Never.

Well at least it can’t possibly get any worse.

Actually it does.

We are now in a position to more fully grasp and gage the scope and scale of the greatest ongoing threat and detriment to commerce everywhere – the single most significant and destructive weapon of mass socio-financial-destruction ever devised. Also innocuously known as the nominal payment-card Merchant Fee.

At this point, to better triangulate our financial reality, it is helpful to pivot our focus from the rates, to the absolute and relative amounts.

If we consider again the amount of the differential on any given day at a stated or represented 1% per annum on, or per, $10 trillion, then it is $687,000 per day (i.e., as so measured on the first day).

At 15% per annum, the difference increases to just under $250 million a day against $10 trillion of principal. That difference accounts for almost half (48%) of all the interest to be paid over 30-years on a $10 trillion starting principal or per $10 trillion of initial principal.

If you were a foreign-power intending to damage and frustrate the economy of your target / enemy, then in order to maintain such damage at the level that exactly doubles the interest-money cost over 30-years (about a stated 15.1% per annum), then you have to find a way to take $250 million a day ($250,000,000) from the target-economy.

The global broadly-defined payment-card industry is currently obtaining the all-in USD-equivalent of $3 billion a day ($3,000,000,000) in concealed-credit-charges and broadly-defined nominal concealed–administrative-charges that are at least dozens of times higher than actual processing costs – against annual global circa $50 trillion of throughput or constructive principal-amount that the nominal merchant fees are charged against. That is 3,000 million per day versus 250 million per day.

If this were a recognised war, then legitimate commerce is under a global 24/7 blitzkrieg and carpet-bombing attack. Even spread over the entire global economy it is still both relatively and absolutely more than ten times worse – more inherently destructive – than the fraudulent calculation device at a stated 15%.

Just the five-year period from 1978 to 1983, especially, demonstrates that the U.S. and Canadian economies were plunged into a massive recession and harvesting of foreclosed properties and corresponding massive loss of equity – often a lifetime’s worth of accumulated equity – through a fraudulent device that removed $250 million per day from the economy (relative to / under the model).

Nominal prime interest rates are now very low – but they are still harvesting over $3,000 million ($3 billion) per day using a different fraudulent device or combination of devices. The economic damage is the same regardless of the label applied to the rake-off.

About $2 billion per day is both created and obtained as a rake-off from new credit run through broadly-defined credit / charge-card accounts. This $2 billion is de facto self-financing because the money / credit to pay for it is created under the transaction.

The other $1 billion is through fixed-fee administrative charges on broadly-defined debit-card transactions and this does reduce the total money supply.

And so there is a balance. If you were to remove 3% per transaction from an economy with a fixed amount of liquidity, then economic activity would very rapidly decline until it caused a general seize-up and collapse. This is what the $1 billion a day in fixed fees (and other costs such as equipment rental fees) on debit card transactions does.

But with the additional $2 billion a day of new money / credit (financial inflation) coming in under the credit / charge-card transactions (backed by ongoing new wages and production) income, there is enough to offset the immediate damage to the economy – or rather to defer its recognition. And so, On to the Main Event:

Mini-Quiz:

1. Which is the greatest amount (per year):

- The combined military budgets of the U.S., China, and Russia,

- The gross income of the poorest 1.5 billion humans, or

- The global aggregate “small transaction charges” on payment-card transactions “to cover the cost of processing the transaction”?

___

The opening quote “…[H]uman beings are surprisingly resistant to conceptual change.” is a reference to Professor (of Psychology) Moti Nissani and an experiment designed by him (in 1985) under which 19 PhD’s from diverse fields were separated into a group who had answered questionnaires establishing or indicating that they would likely have to look up the formula for determining the volume of a sphere.

As part of the experiment, these 19 participants were nominally given the formula for determining the volume of a sphere, and also asked to make empirical measurements with two real spheres of different size.

All 19 test subjects employed various forms of rounding-error in their empirical measurements to converge upon the formula-calculated value, and vice versa to a more limited extent. None of them correctly solved the experiment – which was to conclude that the empirical measurements prove conclusively that the formula they had been given is incorrect.

It was as if their process of reasoning precluded even considering it as a possibility, and they then bent-their-reality to accommodate the bad formula and in disregard of direct essential, material, and verifiable, conflicting information.

No academic discipline could survive for long under such a paradigm – save one. The study of money and credit is the ultimate anything-goes playground-of-the-mind fantasyland, where the conclusion is always firmly established before any inquiry is made.

Never question information propagated by an established authority is the ultimate or supreme “false premise” in a world that is ever more saturated in and by systematized delusions:

“A “systematized delusion” is one based on a false premise, pursued by a logical process of reasoning to an insane conclusion ; there being one central delusion, around which other aberrations of the mind converge.” Taylor v. McClintock, 112 S.W. 405, 412, 87 Ark. 243. (West’s Judicial Words and Phrases (1914)).

Judges of the appellate courts in the Western World, for example, are presumed to be among the most innately intelligent humans – but it is just that – bare presumption.

If you analyze the processes employed by the directly-appointed former-bank-lawyers calling themselves appellate court judges in Canada, it reveals the men and women behind it to be, at best, intellectual charlatans.

In this case, the subject matter of their ongoing performances is the nominal rate of interest – a manifestation of the fraudulent device as if it were a type or species of rate of interest.

But a nominal rate of interest – and as employed in fact (and by definition) – is no more a rate-of-interest, than a teddy-bear is a type or sub-species of bear. The judges cannot grasp that. They cannot truly reason beyond labels.

There is more than sufficient evidence, regardless, to convict the judges of at least criminal dereliction of duty. I personally participated in and did research for about a dozen separate civil Court actions on the issue from 1990 to 2004.

In every case, we ought to have won by default just on the basis of the collateral accounting laws and regulations that require interest rate disclosure to be accurate to within 1/8th of 1% per annum.

Even if the nominal-rate / fraudulent-device story were legitimate, it still only works up to a limit of about a stated 5% per annum, which is the point at which the error exceeds 1/8 of 1% per annum.

The first time it happened, a colleague commented to the effect, after reading the written judgement of the Court – “It looks like they forgot to address the disclosure accuracy laws.”

But they did not forget – it was a barrier to the answer they needed, and so it was simply ignored, repeatedly, persistently, and pathologically.

The true reveal occurred in 1971 when it was actually and officially discovered that the credit systems’ set of sacred special scales for weighing its most significant form of gold were both massively and insidiously rigged in favour of the purported middleman (and pillars of the community) whom society had trusted to do the calculations fairly and accurately.

The system was thus compelled to either come clean, or else go with damage-control to salvage and perpetuate the device throughout the rest of the world. It chose the latter.

- Keeping the other parameters constant to demonstrate the relative effect. In practice if the switch were turned “off”, then the monthly payment of combined principal and interest would be commensurately reduced, and both the borrower and the saver would be accurately informed that the rate of interest is 15% per annum. ↑

- Technically, the device is malum in se or evil / wrongful of itself, and so has always been illegal under the criminal law. What happened in 1971 was that upon official recognition of its fraudulent substance and nature, the creditors in the U.K. could no longer deny their awareness of its fraudulent substance. It remained criminal during 1971 to 1974 (and beyond) notwithstanding the de facto government policy not to prosecute during that interval until the new law (Consumer Credit Act) in 1974 requiring all creditors to use the actuarial formula. ↑