A Black woman among the working-poor is faced with a dilemma. She is a sole wage-earner and has a family to feed. She also has an electricity bill that is past due, and if she does not pay it by the next day, her power will be cut off, and there is $100 in penalties and reconnection-fees that will be added to the bill.

She has been working nights at a second job and is expecting $400 but will not receive it for another ten days.

Her only practical option is one of the local payday-loan stores. She has made some enquiries and the best deal that she can get is $335 cash today for her net $400 paycheck in 10-days. The $65 in total charges seems very high, but it is better than incurring the $100 in total penalties on the electricity bill, and so she takes the deal.

Question: Is it more inherently racist for the payday-loaner to tell the woman that the rate of interest is 708% per annum on the at-least-implied assumption that she is not well educated in math, and likely does not know how to do the rate calculation herself?

Or is it more inherently racist to simply tell her the truth that the rate of interest is 64,622% per annum, and that she can take-it or leave-it?

Or perhaps it has nothing to do with race at all?

If you are among the vast majority who don’t have a clue what I am talking about – then read on, because that in a sense is the whole problem.

The nominal method – Another glitch-in-the-matrix of Financial Apartheid

There is a math-error in the way lenders / creditors determine interest charges under loan contracts, and which at its current level is so ridiculous as to reveal a total fantasy-fiction-world on a par with that in the film The Matrix.

When the agreed interest rate is absolutely low or close-to-zero, the math-error is very small. Under the nominal method, so-called, an agreed or stated rate of 3% per annum is converted into a real rate of 3.0416% per annum. Accurately stated, the nominal method is the “Well-it’s-pretty-close-as-long-as-the-real-rate-is-really-low-method”.

In practical terms it means that based on the required monthly payment on a 30-year mortgage, the same mortgage principal amount that is paid off in 30-years at a nominal 3% per annum, is paid off in only 29.75 years at a real 3% per annum.

It works the same on all debt, but a 30-year mortgage is a good and consistent way to demonstrate the significance of the relative differences at different rate-levels. Just think of all debt in the economy as one big rolling 30-year mortgage to appreciate what it means to the bankers and other alleged financial-middlemen.

While it remains what the law calls malum in se or evil / wrongful-of-itself (i.e., a fraudulent act) for a financially-sophisticated lender to cheat a less-sophisticated borrower of any amount using mathematical-trickery, at a stated 3% per annum it is not something that the masses are going to start a civil war over.

At an agreed or stated 6% per annum, however, the nominal method converts it to a real 6.167% per annum. Note especially that by doubling the agreed rate from 3% to 6%, the additional amount or overcharge is increased by just over four-times from 0.0416% to 0.167%. That is because the math-error in the nominal method is an exponential math-error.

In practical terms it now means that based on the required monthly payment on a 30-year mortgage, the same mortgage that is paid off in 30-years at a nominal 6% per annum is paid off after only 28.6 years at a real 6% per annum. Now the error and extra amount accounts for an extra 1.4 years of payments and about 8% of all the interest money to be paid over the 30-year period.

Now, at this point we hit a kind of general historical limiting-factor because for about its first 100-years the Bank Act, at various times, limited the rate of interest on a nominal bank loan to a maximum of either 6% or 7% per annum.

Up until this point the general approach had been for the financial-people to admit the fact of the difference while avoiding any discussion of its fraudulent substance, and by asserting that the difference is trivial.

Testifying in Canada under oath before the Select Standing Committee on Banking and Commerce in 1928, for example, the spokesman for the private chartered banks (Mr. M. W. Wilson) said of the nominal method discrepancy / overcharge:

Mr. Wilson: It [use of the nominal method] makes an infinitesimal difference. That is not the reason it is done, I give you my word for it.[1]

Likewise the (mostly banker-written) Encyclopedia of Banking and Finance technically acknowledged the fact of the math-error, and of the at-least-constructive fraud, in its 1938 Edition under the general heading of Interest:

…if the interest period is less than one year, the [amount of interest determined under the] nominal…interest rate is greater than the true interest rate… Practically, however, the difference is disregarded.

Really? Can anyone seriously imagine bankers disregarding a factor that at-the-time accounted for up to 8% of all the interest money to be paid on a mortgage over its entire 30-year term?

Let us now regardless continue into the post-1968 era after the interest rate limits were removed from the Bank Act. And bearing in mind that bank Prime in Canada peaked at a nominal 22.75% in August of 1981. And at 20.5% in the U.S., also in August of 1981.

By a stated or agreed 15% per annum, the nominal method increases the real rate to 16.1% per annum and the math-error or overcharge is now 1.1 percentage points or 6.65-times greater than at a stated or agreed 6%. At this level, a two-and-a-half-times (2.5-times) increase in the stated rate from 6% to 15% results in a 6.65-times increase in the relative math-error.

In practical terms it now means that based on the required monthly payment, the same mortgage (or aggregate debt) that takes exactly 30-years to pay off at a nominal 15% per annum, is paid off in only 18.7 years at a real 15% per annum.

The math-error and fraud now increases the total amount of interest money to be paid under the contract by 93%, per se, and accounts for 48% of all the interest money to be paid over the entire 30-year period. By a stated 15% per annum, we have reached the fringe of what is called the exponential-runaway-point.

Still think the bankers maybe haven’t noticed?

At this point, in 1974, three critical events occurred.

The first is that in the U.K., the U.S. and Canadian nominal method was recognised and banned as criminal fraud on the grounds that it is “false and seriously misleading”; and which was itself the understatement of the century.

The second is that creditors in the U.K. more or less immediately reacted to it by switching to a different but equally criminal means of achieving the same result. Whatever it took to understate the real interest rate to the people whose wealth they were harvesting by criminal means.

And third is that there was no material public recognition of it in the U.S. or Canada. No screaming headlines like:

U.K. bans U.S. method of interest calculation as criminal fraud!!!

The same families who were (and remain) the primary owners of both the banks and the broadly-defined media decided that the public had no pressing need-to-know – and the creditors in both countries simply carried on systematically lying about the real interest rate as if nothing had happened.

When the nominal / alleged U.S. Fed Rate peaked at 20.5% in August of 1981, the same mortgage (or total debt in the economy) that takes 30 years to pay off at a nominal 20.5%, is paid off in just 13 years at a real 20.5%.

Based on the identical physical contract, if the lender merely claims to have interpreted the agreed interest rate as nominal and not real, then the borrower is condemned to pay three times as much interest money on a 30-year debt that is technically paid off in-full by the same monthly payment after 13 years at the same real rate.

And yet the then equivalent of what is today 25,000-plus PhD’s in Economics worldwide remained utterly oblivious to it. How is that even possible?

This cognitive-cancer then regardless continued to metastasize unabated through the 1980’s until I challenged it in the Canadian Courts in 1989 on the grounds of its prima facie fraudulent substance.

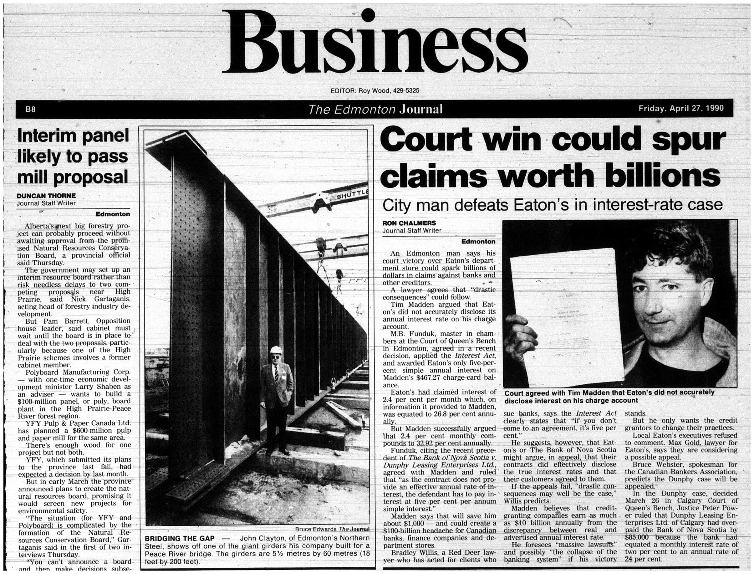

In April of 1990 I won the case (Edmonton Journal, April 27, 1990):

But my legal win in the Courts was relatively short-lived.

It was fully and finally negated / overturned at the Supreme Court in Canada in 1995 after the lawyers realised that if allowed to stand it was going to cost the banks and the legal profession in Canada a minimum of $100 billion in refunds and write-downs just to pay back the overcharges, and as much as $1 trillion ($1,000,000,000,000) if all creditors in Canada were restricted to 5% per annum for non-compliance as provided under the federal securities law of 1897 that had made the nominal method illegal without concurrent disclosure and declaration of the real interest rate.

The Parliamentary records of debate also make it clear that the legislators in 1897 recognised the nominal method as fraudulent when they enacted the law against it. Such also directly defeated the creditors’ official position in my case that there are two equally valid ways of doing it and that the creditors merely choose the one that is more advantageous to themselves.

Because the creditors had then been simply ignoring the federal securities law for almost 90 years, their lawyers and their malpractice / negligence underwriters would become co-liable for all of the constructive losses and costs of paying it back.

And so aided and abetted by the former-bank-lawyers who had been directly appointed or elevated as judges to the Appellate Courts and the Supreme Court by the former bank-director (Brian Mulroney of the Canadian Imperial Bank of Commerce (CIBC)) then occupying the Office of the Prime Minister, the entrenched-money-power led us to cross the Rubicon and into the Financial Twilight-Zone of modern Payday-Loans and Micro-Loans.

As a general frame-of-reference, between a stated rate of 1% per annum and a stated rate of 30% per annum, the relative error in the nominal method increases exponentially by a factor of 1,000-times. It is 1,000-times greater at 30% than at 1%.

Above that it gets ridiculous.

Consider the following (and typical) CBC (Canadian Broadcasting Corporation) article nominally advising Canadians on the high cost of payday-loans (cbc.ca website, Payday Loans: Short-term money at a hefty price. October 4, 2006) (in material part):

How much do payday loans cost?

They are the most expensive legal way to borrow money

.…

Typically, you can expect to pay up to $100 in interest and fees for a $300 payday loan. The Financial Consumer Agency of Canada says that amounts to an effective annual interest rate of 435 per cent on a 14-day loan [33.3% for 14 days].

In fact the real interest rate defined by that transaction is 180,754% per annum.

If you had an effective / real-interest-rate daily-interest-accrual savings account, then it would have to pay interest at an annual rate of 180,754% for you to earn 33.3% over 14 days (i.e., to earn $100 of interest on a $300 deposit over 14 days).

If you go to any medical professional with a virus that grows at an observed rate of 33.3% over 14 days, they will tell you that its rate of growth per annum is 180,754%.

If you ask any competent economist for the annual rate of price-inflation if the observed rate is 33.3% over 14 days, they will tell you 180,754%.

It is only with respect to this uniquely-special-virus called debt-or-loan-interest, that if it grows at an actual rate of 33.3% over 14 days, then the entrenched-money-power that feeds upon it, and otherwise measures financial performance by the basis-point or 1/100th of 1%, will tell you with a straight-face that it is only 435% per annum, even though they are in the business of knowing that it is 180,754%.

Note also that the Financial Consumer Protection Agency has now also entirely dropped or abandoned the nominal-rate pretence and is now also directly lying by claiming that 435% is the “effective [real] annual interest rate”.

And yet after the CBC having directly featured and understated the real interest rate by a factor of 400-times on its national and international website, no one seems to have complained or even mentioned the fact of it.

I have not been keeping track of the grand-totals for a few years but according to the 2016 report from the Financial Health Network in the U.S.:

“This year [2016], we report that financially underserved consumers [mostly the working-poor] in the U.S. spent approximately $173 billion [$173,000,000,000] in fees and interest during 2016 to borrow, spend, save, and plan across 29 financial products in this diverse and continually growing marketplace.”

So in most simple terms, a very disproportionately-large number of the working poor in the U.S. are being systematically looted of at least tens of billions of dollars annually at average interest rates of about 30,000% per annum.

A very disproportionate number of these people are Black, but they are not being looted and exploited because they are Black. They are being looted because they are poor. The same goes for the disproportionate number among the working poor who are Hispanic. And an ever-growing number and proportion of Whites are being systematically looted as they too fall into the ranks of the working-poor.

If we had real truth-in-advertising there would be signs everywhere that say:

Access to short-term working-capital:

Wealthy Whites: 3% per annum.

Wealthy Blacks: 3% per annum.

Wealthy Hispanics: 3% per annum.

Wealthy Asians: 3% per annum.

Poor Whites: 30,000% per annum.

Poor Blacks: 30,000% per annum.

Poor Hispanics: 30,000% per annum.

Poor Asians: 30,000% per annum.

The real trick being pulled is getting us all to believe that it has much to do with race at all. Actually the real trick is getting us all to not think about it at all.

And the unstated actual and real justification of the entrenched-money-power doing the looting is: But if we told the truth there would be massive social unrest, and so we are really doing everyone a favour by telling them that the rate of interest is 100-times lower than it really is.

If the reader is confused or not quite grasping what is going on – just think Bernie Madoff.

You may recall that Mr. Madoff ran one of America’s premier Wall Street investment companies for 25 years as a naked-ponzi / pyramid scheme that collapsed with the late 2008 financial panic.

From Day-One and for 25 years he admitted that he had never made a single investment on behalf of a client, and had paid all returns to his then current investors from the new and ongoing investment money that he received from new investors.

And so here again, how is that even possible? Let alone in the most allegedly intensely-regulated financial environment on Earth where the primary function of the entire SEC (Securities and Exchange Commission) is to make certain that alleged investment firms are not running ponzi schemes?

Answer: It isn’t. It is not possible at all. That’s the point.

It is just another glitch-in-the-matrix revealing that it is all fraud, all the time. The nominal method is just one of myriad instruments of de facto Financial-Apartheid that ensure that ever-increasing numbers of the working-poor representing all races are drained of their working capital at average rates of 30,000% per annum while the entire financial and academic worlds remain oblivious to it.

They don’t want to see it, and so they don’t see it.

The object and intent of it is not greed – it is to deliberately plan and ensure that the working-poor stay that way – forever.

It is not about greed – it is about domination for its own sake.

If we could go-back-in-time and put-back the minimum $1 trillion-plus of math-error-money that these financially underserved families have been looted-out-of over just the past 20 years, there would almost certainly be no rioting today. And – as an added bonus – there very likely would be vastly reduced excessive use of force by the police.

The stark reality is that those who comprise our global-political-and-financial-management-superstructure possess a genuine and sincere belief that you can avoid the real and brutal consequences of exacting interest at 30,000% per annum from the working-poor by merely convincing the target / victim that it is only 300%.

Or rather more likely, at the highest levels they know exactly what they are doing – and they just don’t care.

It is not that Black Lives and Hispanic Lives and White Lives don’t Matter – it is just that, if and when they are poor lives, they are practically disregarded.

Either way, at what point do you think that the entrenched-money-power-parasites are going to come-clean on the math-error in the nominal method and tell the masses that, by total amount, the cumulative overcharge is now greater than all debt everywhere in the world – and by several times over?

How about: Never.

And that is just since 1974 when the nominal method was nominally banned in the U.K. as criminal fraud on the grounds that it is false and seriously misleading. From that point on it became impossible to even feign ignorance of its egregiously fraudulent substance. That is what caused the former-bank-lawyers running the Appellate Courts in Canada to panic when confronted with it in 1994 / 95, and then to respond with:

The United Kingdom has devised a complicated formula which is incorporated into statute law for dealing with disclosure requirements in similar circumstances.

Lawyers are trained in how to deceive humans by stringing together statements that are not categorically false. The better they are at it – the more likely they are to be appointed judges to look after the interests of the entrenched-money-power.

It is regardless very likely somewhat more than coincidence that the ever-building number of these glitches-in-the-matrix had crossed a critical threshold right before the real or imagined Coronavirus outbreak, and which was itself then near-inconceivably simply abandoned in favour of the George Floyd riots.

The good news is that based on my own extensive research and observations over the past thirty years – these people – the entrenched-money-power and their de facto administrative agents – are not master manipulators – they are simply criminally-incompetent language-manipulators who are making it up as they go along.

The bankers and their solicitors and the rest of them are not that bright. The only reason they appear to own and control everything is because their great-grandfathers accidentally discovered The Great Stupid-Ray that keeps the rest of us believing whatever they tell us no matter how transparently fraudulent and ridiculously stupid.

But it is critical to exercise a little restraint because if anyone ever accidentally trips over the power-cord to The Great Stupid-Ray, you don’t want to be caught systematically harvesting interest money at up to 180,000% per annum from the working-poor at the moment the masses cognitively wake-up.

They might even be a little pissed about it.

APPENDIX on Methodology

Excerpt from Nominal my butt

Calculated to deceive

The U.S. (and Canadian) nominal method is recognised as criminal in the U.K. for very good reasons. The 1968-71 U.K. Crowther Committee investigated about a dozen different alleged interest calculation methodologies then in use in the U.K. The final report of the Committee identified the effective-rate or actuarial method as the one and only method that maintains the time value of money inherent to the annual (growth-rate) rate disclosed.

Notably, the Crowther Committee expressly identified and emphasized that the so-called “nominal” method is an especially nasty or specious form of deception precisely because it appears to make sense to those not sufficiently educated as to why it makes a difference, or even to know that there is a difference.

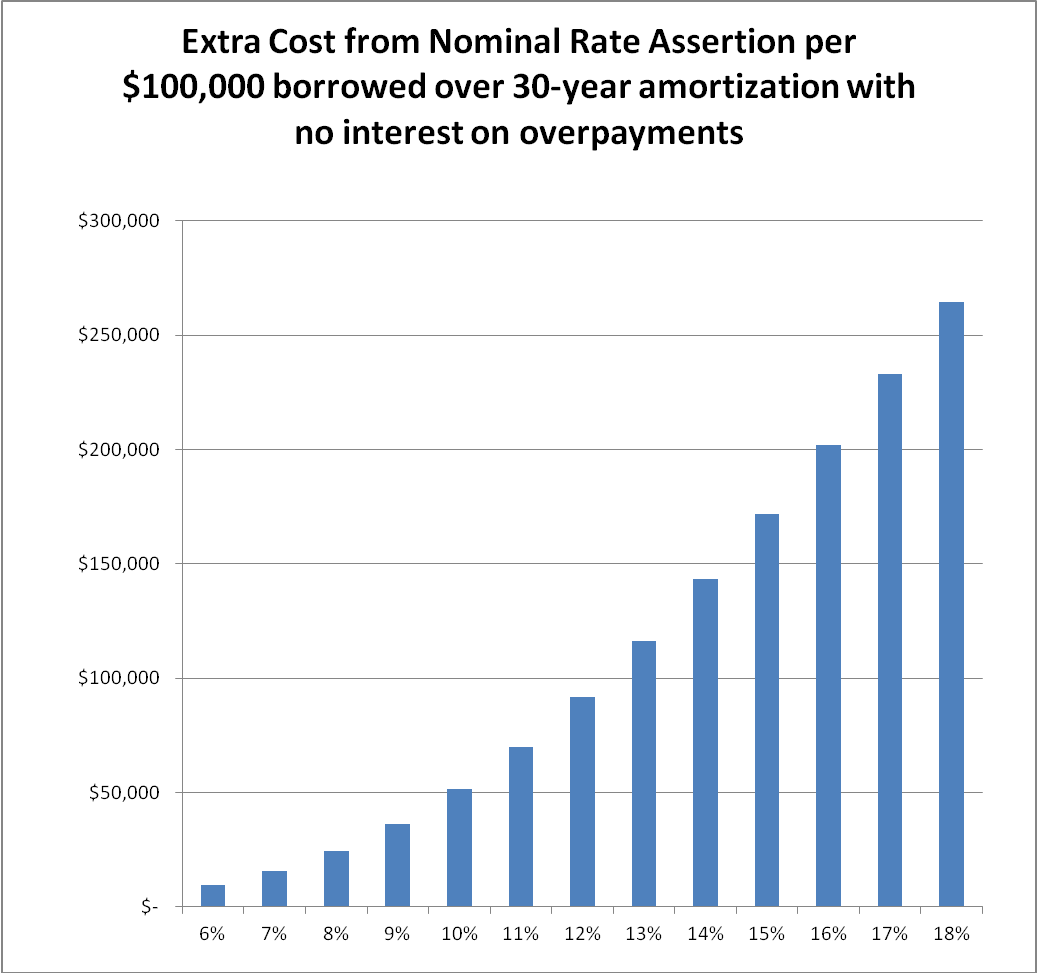

The following comparison has been designed so as to demonstrate the cost of the nominal method in terms of money (dollars) out of a debtor’s or borrower’s pocket instead of just rate differences. Because most consumer interest payments are made monthly we will deal with the application of the nominal method to monthly interest charges or calculating monthly as it is sometimes called in the finance business.

The nominal method is also sometimes referred to as the straight division method because the creditor takes the stated annual rate and then divides both components of the rate by the number of payment periods in a year. For example, if a debtor agrees to pay interest at 12% per annum by monthly payments, then the creditor will assess 1% each month.

Most American (and Canadian) consumers think that such procedure is correct. Financial institutions (meaning the people who run them, and most certainly those who own them) are in the business of knowing that it is not. It would not be such a problem if the error were consistent, but, again, the nominal method error increases exponentially in favour of the creditor as the stated annual rate is increased. At the higher levels associated with credit card account rates the error is positively obscene, and a genuine crime against humanity on payday loans.

The first step is to be certain to compare like things, and to use a long enough period so as to clearly demonstrate the significance of the thing being measured. A 30-year period is used here because it is the standard amortization period on a residential mortgage in the U.S. Think of it also as your working-lifetime–peak-earnings-years-period and how and why your earnings are quietly re-directed to the owners of the private financial system.

Using $100,000 as a comparison loan or advance amount, over 30 years at 6% per annum using the nominal method, the required monthly payment (combined principal and interest) will be $599.55. If the interest charges were determined at a real 6% per annum, then the monthly payment would be only $589.37. Comparing two different monthly payment streams, however, using two different (alleged) calculation methodologies, would confound the results. To determine the extra cost of the nominal method, and only the nominal method, it is necessary to compare identical payment streams applied against identical loans where the one and only difference (single variable) is the calculation (interest assessment) method.

Given a fixed loan amount ($100,000) and a fixed monthly payment amount ($599.55) the only way to measure the extra cost in dollars is by the time (and total payments) required to pay off the debt / contract (the amortization period). (Also note that such is the actual basis on which financial contracts trade in the financial markets, i.e., total time-adjusted-payments required and not the stated interest rate).

At a real 6% per annum a $100,000 advance requires 28.67 years to pay off with monthly payments of $599.55. If the creditor uses the nominal method, then the same advance takes exactly 30 years to pay off based on the same monthly payment. The cost of the nominal method (i.e., extra cost from passing off the Annualized Amount or PPFR [Payment Period Frequency Rate] for the rate of interest) is slightly less than 16 extra payments of $599.55 for a total of $9,564 per $100,000 advanced. The total interest cost is the total payments (360 months x $599.55 = $215,838) minus the principal advanced ($100,000) with the result $115,838.

The $9,564 difference (the Banker’s Bonus) from the use of the nominal method therefore represents a 9% increase in the total dollar cost of credit, or about 8.25% of the total interest money paid / collected over the 30 year period.

What then happens to the extra cost when the same technically incorrect nominal technique or procedure is applied at a claimed 15% per annum? That is the approximate weighted average stated credit / lending rate over the 30 year period 1974 to 2004 (about equal to (royal bank of canada) prime plus 3% as a purported variable rate). Does the error stay the same at about $9,500? Does a two-and-a-half-times increase in the stated rate from 6% to 15% cause a proportional increase in the extra cost from $9,500 to about $23,000 for each $100,000 advanced? Or is there something more but which bankers never talk about in public?

Again the example is a $100,000 advance repaid over 30 years and at a nominal 15% per annum the required monthly payment is $1,264.44. If interest were at a real 15% per annum, then the monthly payments would be about $75 less at $1,189.46, but once again we want to isolate the extra cost of the nominal method and so that is the assumed (or control) payment amount.

At a real 15% per annum a $100,000 advance requires 18.68 years to pay off based on monthly payments of $1,264.44. If the creditor uses the nominal method, then it takes exactly 30 years to pay off the same advance with the same monthly payment. Now the cost to the debtor (and bonus to the creditor / bank) is 135.88 extra payments (11.3 years) of $1,264.44 per month or $171,806 per $100,000 advanced!!!

Here again the total interest cost is the total payments to be made (360 x $1,264.44 = $455,198) minus the principal sum advanced ($100,000) with the result $355,198. Now the $171,806 difference represents a 93.68% increase in the total dollar cost of credit or 48% of the total interest paid/collected over the 30 year period!!! The interest cost should be $183,436 over 18.68 years, but at this higher level the exponential error in the nominal method procedure adds 11.32 extra years to create a debt with total interest payments of $355,198.

What may otherwise be made to appear to be a small difference is actually a form of mathematically engineered leverage (actually double-leverage or cross-leverage or feed-back-loop-leverage) that increases the total cost of credit (cost of the contract) by 93% at a stated interest rate of 15% per annum. A mortgage or any amortized term loan is designed with the monthly payment amount determined so as to be just so slightly more than the initial (first month’s) interest cost so that the advance will take 30 years (or adjusted to whatever desired amortization period) to pay off. By using the nominal method, at any given (claimed) rate, the creditor gets to both collect larger payment amounts which pay down the advance relatively quickly at the rate stated and collect those larger payments for 30 years anyway.

It is also irrelevant that many creditors no longer make advances for fixed terms of 30 years. The 30-year period is simply a standardized reference period by which to demonstrate and measure the radically different effects of the same math procedure error at different nominal interest rates. At 15% per annum, over any given 30-year period, the credit industry will increase the total amount of interest money exacted (harvested) and/or assessed from / against all debtors by 93% by simply using the nominal method (again, as measured at the end of the period).

Of course the credit agreements don’t actually say “the nominal method”, much less explain what it means. In Canada it is simply the explanation given if and when (rarely in practice) a debtor discovers that their monthly payment does not correspond to the rate of interest stated and declared in the agreement. In the U.S. there is no need for an explanation because the fraudulent nominal method is required by law.

If the creditor were to deliberately set out to defraud the debtor by obtaining their agreement / consent to one rate while stipulating for payments that correspond to a higher rate, then they need not do anything different.

The 6% and 15% per annum examples are highlighted in the table below.

Next Page

Extra Cost from use of recognized fraudulent “Nominal Rate Method”

based on 30-year Amortization per $100,000 advanced

Nominal

Rate Per Annum |

Monthly

Payment Amount |

Amort.

Period (time to pay off) |

Amort.

Period without Nominal Assertion |

Extra

Payments needed to pay out same loan |

Total Extra

Cost from Nominal Rate Assertion |

Relative Increase

in Total Cost (without interest on extra payments) |

Absolute Increase

in Total Cost of Credit (with interest on extra payments at same rate) |

0% |

$277.78 |

30 years |

30 years |

0 |

$0 |

0% |

$0 |

1% |

$321.64 |

30 years |

29.98 years |

0.27 |

$87.92 |

0.56% |

$87.92 |

2% |

$369.62 |

30 years |

29.90 years |

1.20 |

$444.55 |

1.36% |

$448.12 |

3% |

$421.60 |

30 years |

29.75 years |

2.98 |

$1,256.10 |

2.49% |

$1,330.99 |

4% |

$477.42 |

30 years |

29.51 years |

5.86 |

$2,799.59 |

4.05% |

$2,856.22 |

5% |

$536.82 |

30 years |

29.16 years |

10.09 |

$5,414.53 |

6.16% |

$5,627.42 |

6% |

$599.55 |

30 years |

28.67 years |

15.95 |

$9,564.00 |

9.00% |

$10,226.49 |

7% |

$665.30 |

30 years |

28.03 years |

23.69 |

$15,758.19 |

12.73% |

$17,546.23 |

8% |

$733.76 |

30 years |

27.21 years |

33.43 |

$24,531.72 |

17.57% |

$28,860.18 |

9% |

$804.62 |

30 years |

26.24 years |

45.18 |

$36,351.30 |

23.71% |

$46,029.68 |

10% |

$877.57 |

30 years |

25.11 years |

58.69 |

$51,502.07 |

31.32% |

$71,615.81 |

11% |

$952.32 |

30 years |

23.87 years |

73.54 |

$70,036.97 |

40.53% |

$109,273.61 |

12% |

$1,028.61 |

30 years |

22.57 years |

89.21 |

$91,767.15 |

51.40% |

$164,167.54 |

13% |

$1,106.20 |

30 years |

21.24 years |

105.14 |

$116,306.77 |

63.93% |

$243,414.09 |

14% |

$1,184.87 |

30 years |

19.93 years |

120.82 |

$143,151.47 |

78.05% |

$357,107.66 |

15% |

$1,264.44 |

30 years |

18.68 years |

135.88 |

$171,806.80 |

93.68% |

$519,135.35 |

16% |

$1,344.76 |

30 years |

17.50 years |

150.03 |

$201,747.44 |

110.63% |

$749,120.41 |

17% |

$1,425.68 |

30 years |

16.39 years |

163.32 |

$232,841.30 |

129.07% |

$1,073,912.81 |

18% |

$1,507.09 |

30 years |

15.38 years |

175.44 |

$264,403.06 |

148.42% |

$1,531,117.56 |

19% |

$1,588.89 |

30 years |

14.48 years |

186.24 |

$295,915.34 |

168.05% |

$2,172,495.87 |

20% |

$1,671.02 |

30 years |

13.60 years |

196.80 |

$328,856.48 |

190.41% |

$3,069,808.94 |

21% |

$1,753.40 |

30 years |

12.82 years |

206.16 |

$361,480.96 |

212.96% |

$4,321,651.31 |

22% |

$1,835.98 |

30 years |

12.11 years |

214.68 |

$394,149.21 |

236.29% |

$6,064,408.22 |

23% |

$1,918.73 |

30 years |

11.47 years |

222.36 |

$426,648.98 |

260.00% |

$8,484,949.11 |

24% |

$2,001.60 |

30 years |

10.88 years |

229.44 |

$459,248.12 |

284.66% |

$11,841,982.54 |

25% |

$2,084.58 |

30 years |

10.37 years |

235.56 |

$491,043.34 |

308.05% |

$16,488,251.18 |

26% |

$2,167.63 |

30 years |

9.84 years |

241.92 |

$524,393.53 |

336.25% |

$22,909,009.85 |

27% |

$2,250.75 |

30 years |

9.38 years |

247.44 |

$556,924.93 |

363.19% |

$31,768,596.37 |

28% |

$2,333.91 |

30 years |

8.96 years |

252.48 |

$589,265.93 |

390.39% |

$43,974,982.25 |

29% |

$2,417.11 |

30 years |

8.57 years |

257.16 |

$621,584.83 |

418.36% |

$60,773,640.32 |

30% |

$2,500.34 |

30 years |

8.21 years |

261.48 |

$653,790.13 |

446.78% |

$83,863,243.77 |

At the nominal 30% annual interest rate on many department store credit card accounts the monthly payment needed to retire a $100,000 debt over 30 years is $2,500.34. If the calculations are done correctly, then the same debt is retired after 8.21 years based on the same monthly payment. At a stated 30% per annum, a real 8.21 year debt costing $146,000 in interest is leveraged by the nominal method into a 30-year debt costing $653,000 in interest! (a 400%-plus increase, per se, in the cost of the contract (meaning the inherent profitability of the industry)).

The second column from the right in the table gives the relative increase in the cost of credit / borrowing. Creditors may claim that money is inherently less valuable in a world with 15% interest rates than in one with 6% interest rates and that it is therefore not fair to simply compare the extra money cost of the nominal method. The $171,800 extra cost at 15%, however, is almost 18 times greater than the $9,564 increase at 6%, representing an absolute increase of 1,800% in terms of extra dollars out of the debtor’s pocket from the math procedure error, per se.

What the second column from the right shows is that regardless of the relative value of money, the nominal method will cost the debtor 93% more of it at a stated 15%, compared to only 9% more money at a stated 6%. The nominal method presents a new and substantially greater real error (fraud) with every marginal increase in the stated annual rate. The cost of passing off a circular reference statement of the number of payment periods in a year gets exponentially more serious as the real interest rate is increased. Every banker knows that, because they are in the business of knowing it.

Picture a donkey with a stick tied to its head on one end, and a carrot dangling from a string on the other, directly above a (stick-length-and-movable) finish-line. The carrot / finish-line is the amortization period meaning the point at which the debt is paid and it is where the donkey (debtor) wants to get by making the monthly payments (walking). The nominal method is the stick which is a special kind of stick that grows exponentially longer (and so moves the finish-line), with increases in the stated/agreed rate, as the donkey walks.

At a stated 3% the special stick only increases its length by about 2.5%, and it takes the first 29.75 years to do so. At this low-end level it is hard to even perceive that the stick changes its length or that the finish-line moves just a little bit further away as the donkey walks toward it. And this is the frame of reference under which the system chooses to recognise the difference – as in: “Well yes the stick itself does grow just a little bit over the amortization period but it’s so small that it is not worth worrying about – trust us”.

By a stated 6% per annum the stick now increases its length by about 9%, and it only takes the first 28.7 years of payments to get there. But by a stated 15%, not only has the stick gotten 93% longer, it only took the first 18.7 years to do it (or to reach the crest-point as it were). Almost half (48%) of all interest to be paid under the contract is due to the increase in the length of the stick (the nominal method / passing-off).

Just rotate the graphs by 90 degrees clockwise to see the relative length of the special nominal method sticks (fully extended) at each of the stated interest rates.

Problem much greater still

The structure of the analysis (thus far) also substantially understates the real financial and economic consequences in that the extra payments made by the debtor are assumed to earn zero interest themselves. For example, at 15% per annum the extra $171,806 is simply the sum of the extra 11.32 years worth of payments as if the debtor would otherwise stuff the money into a sock or under a mattress. If the lost opportunity cost is taken into account (i.e., the true financial and economic damage, and unjust enrichment of the creditor) the amounts are greater and increasingly so at higher stated rates (e.g., $519,135 per original $100,000 at 15% (last column on the right in the table)).

Mathematically, the proper way to look at it or to measure it is to assume that the debtor has up to several other loans or advances and at the same rate of interest such that the extra payments on the first advance could be used to pay down the debt on the second and subsequent advances (or even put into a personal investment account (again with interest at the same rate)). At the end of the 30 year comparison period the debtor’s total debt on all advances would be $519,135 less (or investment earnings $519,135 greater) based on a nominal rate of 15% (even vastly more if the overpayments on the mortgage could be applied entirely to higher-rate credit card debt). At 6% the foregone interest on the overpayments is only the $662 difference between $9,564 and $10,226.

At just a stated 1% per annum the difference is indicated as $87.92 in both columns (with and without interest on the overcharges). In fact the “with interest” amount is ever so slightly greater, but not enough to show / force an extra cent on the spreadsheet.

The overpayments with interest, from the far right column, are the true measure of the benefits to the institution and cost to the debtor (and society in the aggregate). Even if a particular debtor does not have other advances to which the overpayments could be applied, the creditor is either in the business of loaning those overpayments to someone else (a small percentage) or using them (the vast majority by amounts) as a deemed equity / capital base by which to advance new (and leveraged) credit at interest.

With interest on the overpayments, if the nominal method error were characterized as a kind of societal-cash/wealth-eating monster, then the monster grows about 50 times larger just between a stated 6% per annum (an extra $10k) and a stated 15% per annum (an extra $500k+), while the broadly-defined global financial academic community remains oblivious to it! “What monster? I don’t see any monster – do I get my bonus now?”

____

The interest rate objectively defined by the example transaction in the CBC website article ($300, for $400, due in 14-days) is just over 180,000% per annum.[2] Here again, it is a fairly simple calculation and easily verifiable:

=(((1+(100/300))^(365/14))-1)

= 1807.54 or 180,754% per annum.

If a virus or price-inflation is growing / occurring at the rate of 33.3% every 14 days, then virtually no educated professional will have any problem determining that the annual rate of growth / inflation is 180,754%. But throw a (credit-based) dollar-sign in front of the numbers and it is as if people’s brains short-out or cannot quite grasp the reality of it and instead go into a kind of systemic denial.

If price-inflation is occurring at a constant rate of 100% per month, then something that costs $100 today will cost $409,600 one-year from now. The annual rate of inflation is literally 409,600%.

If I were to respond to the reality of it with: “Yes but 100% times 12 is 1,200%, and there are in fact twelve months in a year”, then I would be sent back to junior-high-school for not paying attention and / or for not doing my homework. It is just plain stupid yet this flat-out-embarrassing logic-flaw has been engrained into the global finance system owned and operated by the same entrenched-money-power that also gains the benefit of the deceit and deliberate mal-education of the masses.

-

Parliament of Canada – Select Standing Committee on Banking and Commerce hearing transcripts, [1928] p. 464. ↑

-

The article also used nominal loan fees to reduce the nominal annual rate from 870% to exactly half or 435%. Apparently even the nominal rate was deemed too high for public consumption. And the constructive disclaimer passing off the responsibility to the Financial Consumer Agency still constitutes criminal incompetence by the CBC. ↑